EFS Reports, Invoices & Tax Statements

On the EFS, you can view, print or download the Activity Report for a single EFS month (more info), or for a range of months (up to twelve). Activity is available on the EFS for the current year and for the four previous years. If you are unable to access reports, see your EFS Administrator for permission. Your EFS Administrator’s name is shown on the home page when you first log into the EFS.

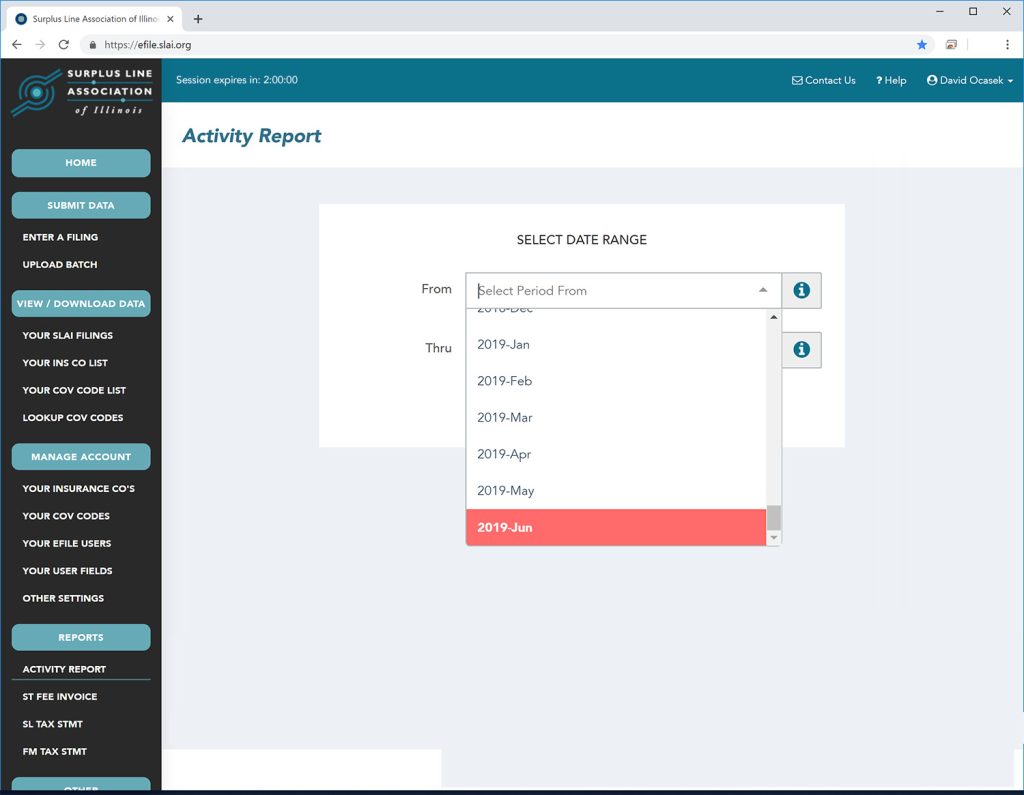

To generate an Activity Report, click Activity Report under the Reports section on the left side of the screen. The following screen will appear and you should pick the beginning period for the report in the From field:

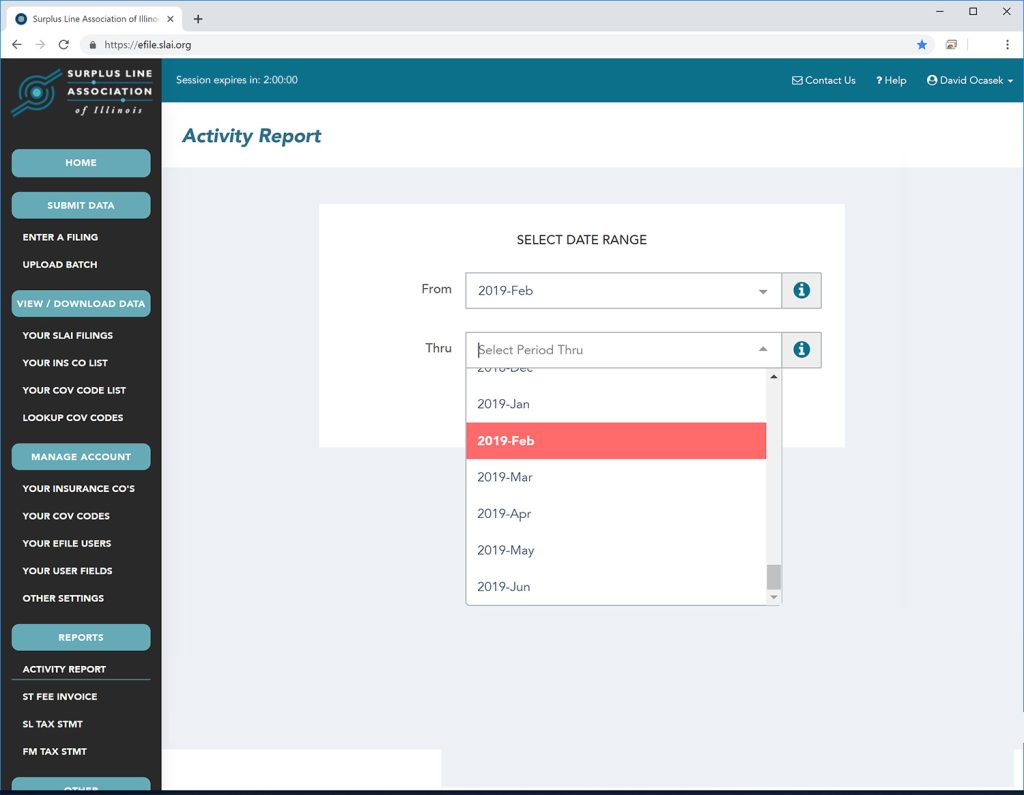

Once you select the beginning period, you will then select the ending period for the report. The Thru field will initially default to the same field you chose in the From field. You can accept that value or pick a different ending period (up to twelve months after the beginning period you chose).

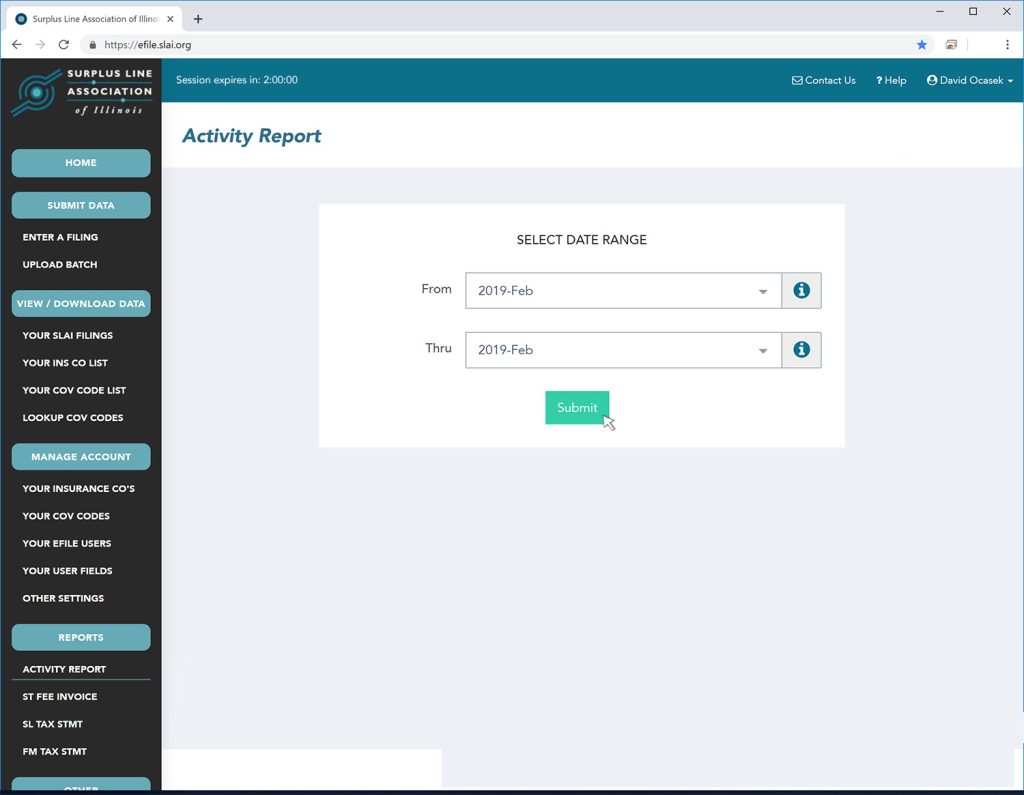

Once you have selected the beginning and ending periods for the report, click Submit:

The report will open in a new tab on your browser. At that point, you can print it or download it as a pdf file.

More Info Regarding Month-End Closing

When we talk about a “month” for the EFS, this doesn’t automatically correspond to the calendar month. For instance, usually the SLAI month “closes” at 4:30pm central time on the last calendar day of the month. So, at 7:00pm on March 31st, it’s technically April for the EFS and you would be unable to edit a filing made that same morning. Furthermore, sometimes the Association “closes” the month a week or so early – usually in June and December – in order to have extra time to prepare and mail out tax statements.

The Association emails your stamping fee invoice to whomever you designated as your “billing contact” at the beginning of each month reflecting any filings made during the previous month, plus any past due amounts. If you are unable to access reports, see your EFS Administrator for permission. Your EFS Administrator’s name is shown on the home page when you first log into the EFS.

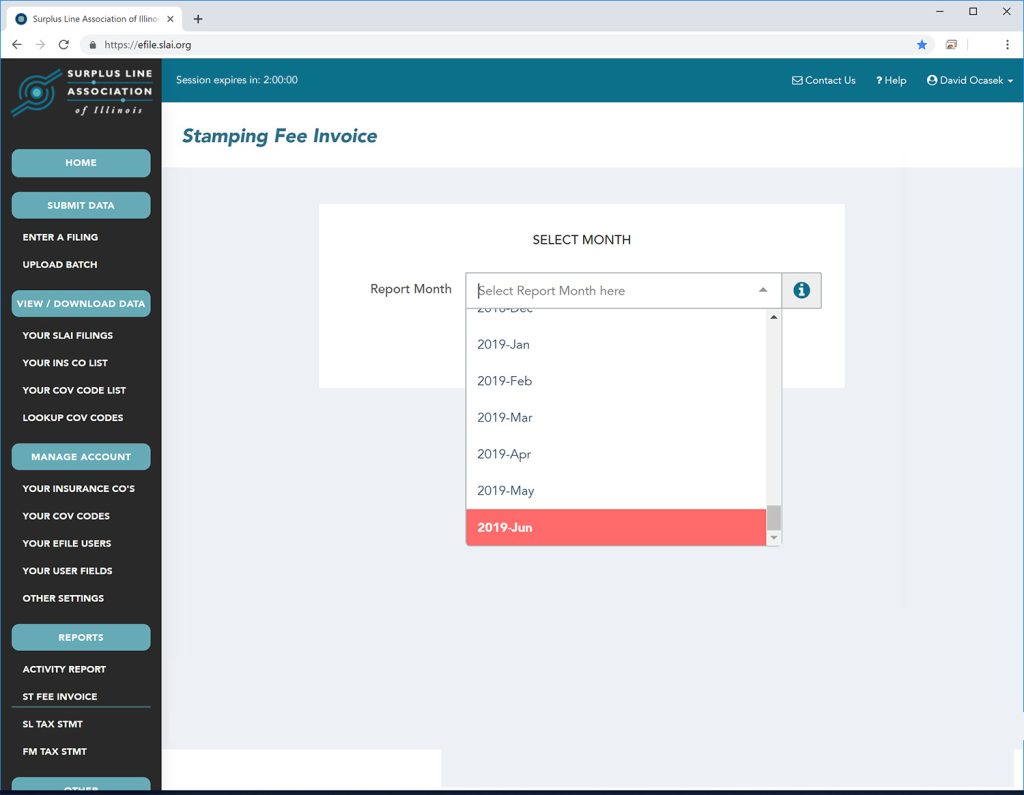

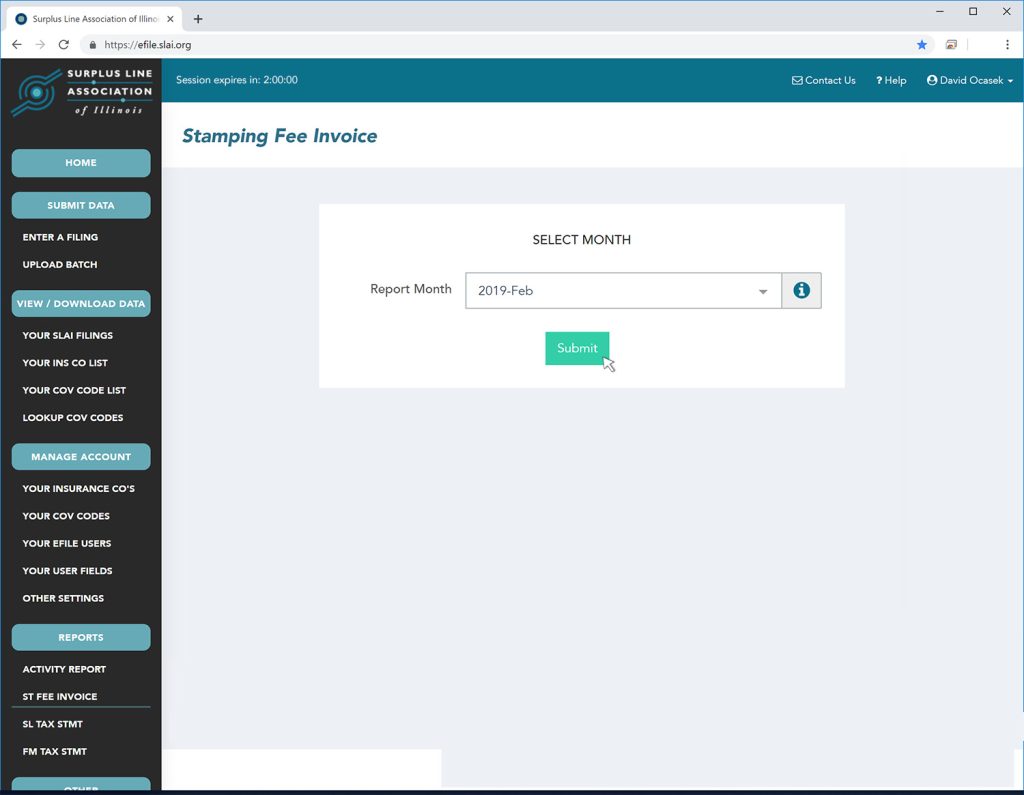

You can reprint a stamping fee invoice from the EFS by selecting ST Fee Invoice from the Reports section on the left side of the screen. Reprints are available for any month during the current year or the four previous years. When you click on ST Fee Invoice , the following screen appears and you need to select the month for which you wish to reprint a stamping fee invoice:

After selecting the month, simply click Submit:

The invoice will open in a new tab on your browser. At that point, you can print it or download it as a pdf file.

You can download and reprint tax statements from the EFS. See instructions for:

Availability

In order to access tax statements, you must have a login for the EFS. If you do not have a login for the EFS you can request one from the EFS Administrator at your company. Not sure who your EFS Administrator is? Contact the Association and we’ll let you know. Once logged in, if you are unable to access reports, see your EFS Administrator for permission. Your EFS Administrator’s name is shown on the home page when you first log into the EFS.

Tax statements are available for reprint only for periods that have completed and are typically available on the 1st business day after the end of the period covered by the tax statement. For example, the Jul-Dec 2025 surplus line tax statement is not available until the first business day of January 2026 and the Jan-Jun 2026 statement is not available until the first business day of July 2026.

Although the list of licensees you will see on the screen during the download/reprint process includes all licensees that were ever registered under your membership, you can only reprint a tax statement for a licensee if:

- the licensee held an active license during the period selected;

- the licensee was registered under your membership during the period selected;

- the licensee did not switch to another membership before the end of the period selected; and

- the period selected is during the current year, or one of the four previous years.

The Association mails out surplus line tax statements twice per year. Statements are mailed at the beginning of July covering the filings made from January to June, and at the beginning of January covering filings made from July to December. They are mailed to the surplus line license address provided by the licensee on the NIPR system, unless a tax statement recipient has been designated. Tax statements must be filed even when no tax is due. Filing due dates can be found here. Never alter the numbers on the statement. Contact us if the numbers don’t look right.

Availability on the EFS

You can also download and reprint your tax statements on the EFS. To access tax statements, you must first log on the EFS. If you do not have a login for the EFS you can request one from the EFS Administrator at your company. Not sure who your EFS Administrator is? Contact the Association and we’ll let you know. Once logged in, if you are unable to access reports, see your EFS Administrator for permission. Your EFS Administrator’s name is shown on the home page when you first log into the EFS.

Tax statements are available for reprint only for periods that have completed and are typically available on the 1st business day after the end of the period covered by the tax statement. For example, the Jul-Dec 2025 statement is not available until the first business day of January 2026 and the Jan-Jun 2026 statement is not available until the first business day of July 2026.

Although the list of licensees you will see on the screen includes all licensees that were ever registered under your membership, you can only reprint a tax statement for a licensee if:

- the licensee held an active license during the period selected;

- the licensee was registered under your membership during the period selected;

- the licensee did not switch to another membership before the end of the period selected; and

- the period selected is during the current year, or one of the four previous years.

Download / Reprint Instructions

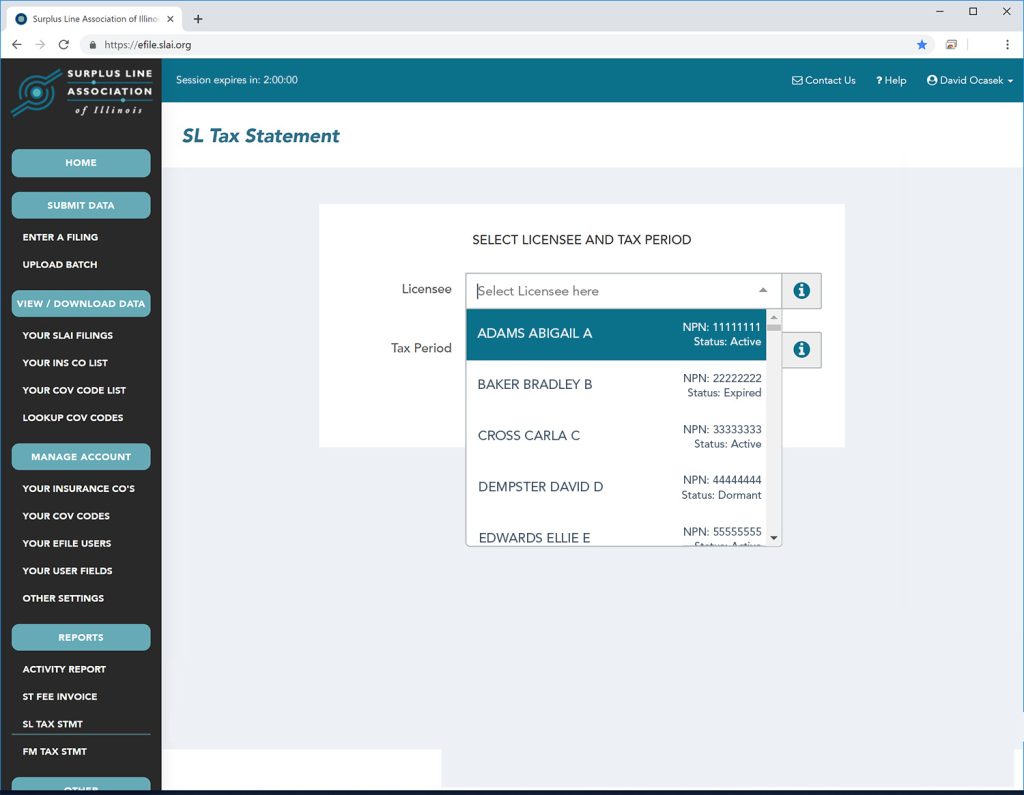

To reprint a surplus line tax statement, select SL Tax Stmt from the Reports section of the menu on the left side of the screen. The screen below appears and the first step is to select the licensee for whom you wish to reprint a tax statement. You can make the selection by scrolling through the list to find the licensee, or you can just begin typing any part of the licensee name or NPN number.

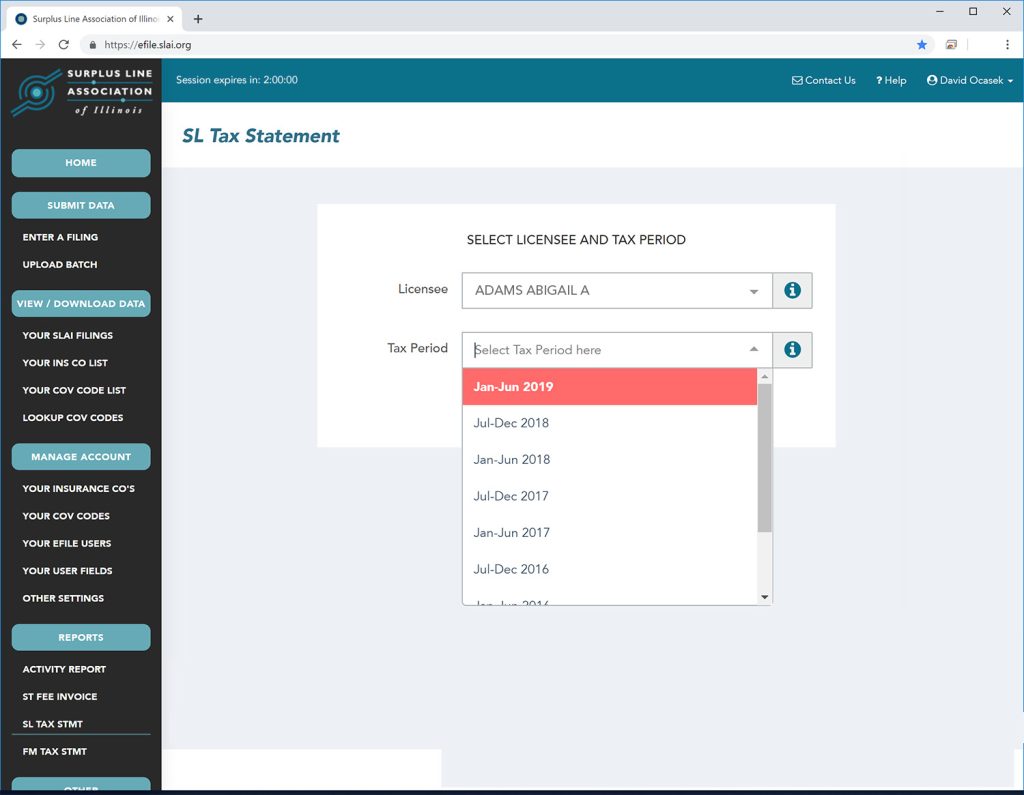

Next, you need to select the period for which you wish to reprint the statement:

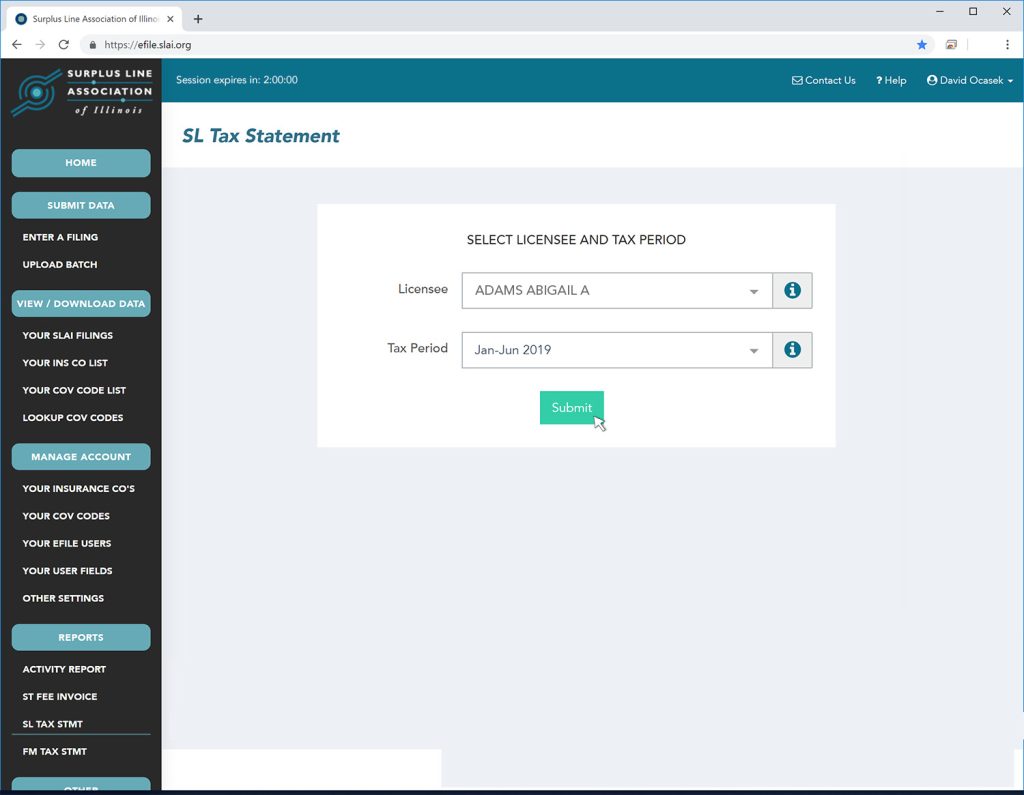

Finally, click the Submit button:

The report will open in a new tab on your browser. At that point, you can print it or download it as a pdf file.

The Association mails out the fire marshal tax statements annually. Statements are mailed at the beginning of January covering filings made during the previous year. They are mailed to the surplus line license at the address provided by the licensee on the NIPR system, unless a tax statement recipient has been designated. Tax statements must be filed even when no tax is due. Filing due dates can be found here. Never alter the numbers on the statement. Contact us if the numbers don’t look right.

Availability on the EFS

You can also download and reprint your tax statements on the EFS. To access tax statements, you must first log on the EFS. If you do not have a login for the EFS you can request one from the EFS Administrator at your company. Not sure who your EFS Administrator is? Contact the Association and we’ll let you know. Once logged in, if you are unable to access reports, see your EFS Administrator for permission. Your EFS Administrator’s name is shown on the home page when you first log into the EFS.

Tax statements are available for reprint only for periods that have completed and are typically available on the 1st business day after the end of the period covered by the tax statement. For example, the 2025 statement is not available until the first business day of January 2026.

Although the list of licensees you will see on the screen includes all licensees that were ever registered under your membership, you can only reprint a tax statement for a licensee if:

- the licensee held an active license during the year selected;

- the licensee was registered under your membership during the year selected;

- the licensee did not switch to another membership before the end of the year selected; and

- the period selected is one of the four previous years.

Download / Reprint Instructions

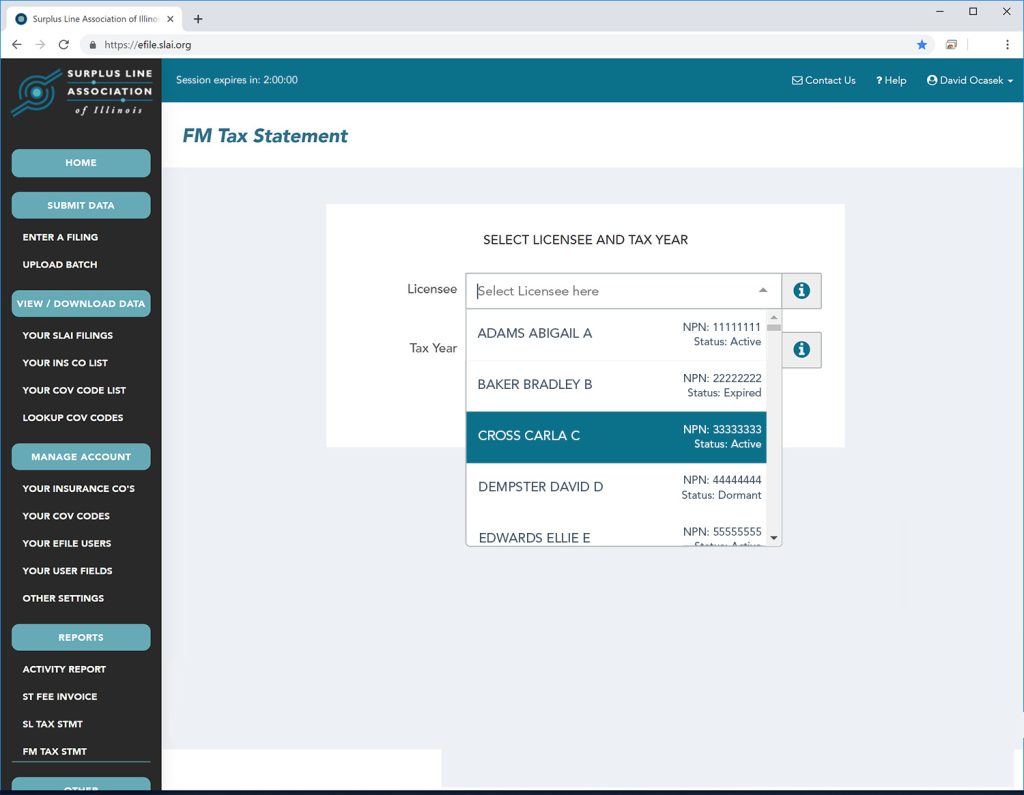

To reprint or download a fire marshal tax statement, select FM Tax Stmt from the Reports section of the menu on the left side of the screen. The screen below appears and the first step is to select the licensee for whom you wish to reprint a tax statement. You can make the selection by scrolling through the list to find the licensee, or you can just begin typing any part of the licensee name or NPN number.

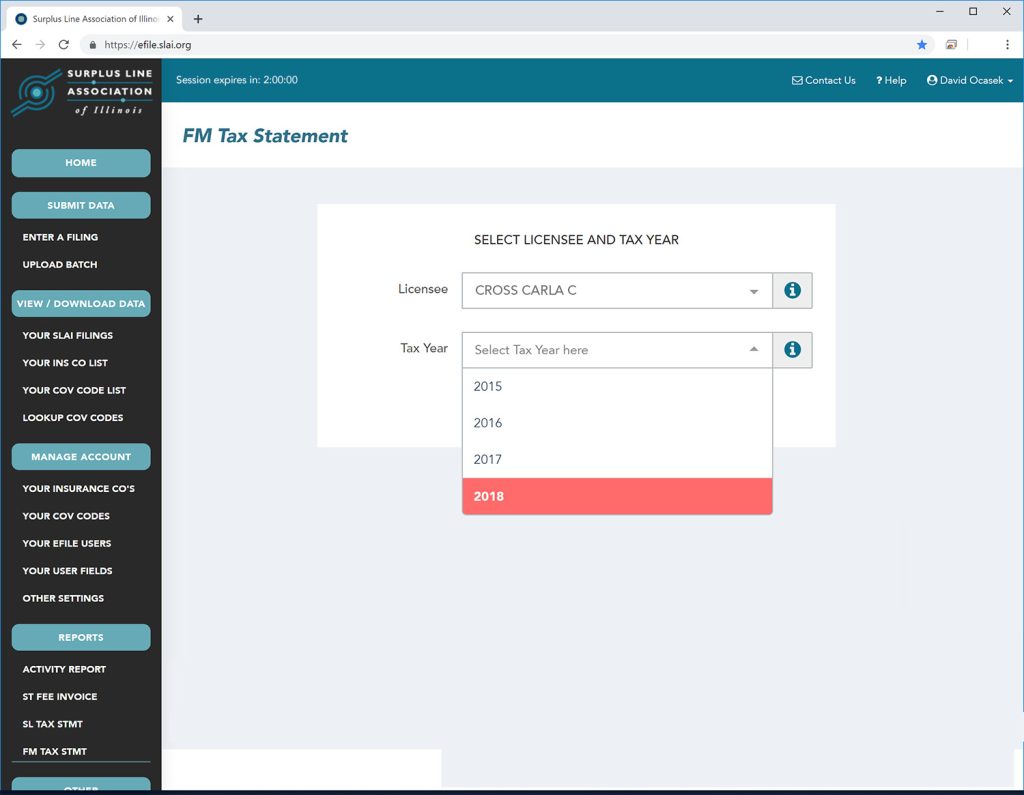

Next, you need to select the year for which you wish to reprint the statement:

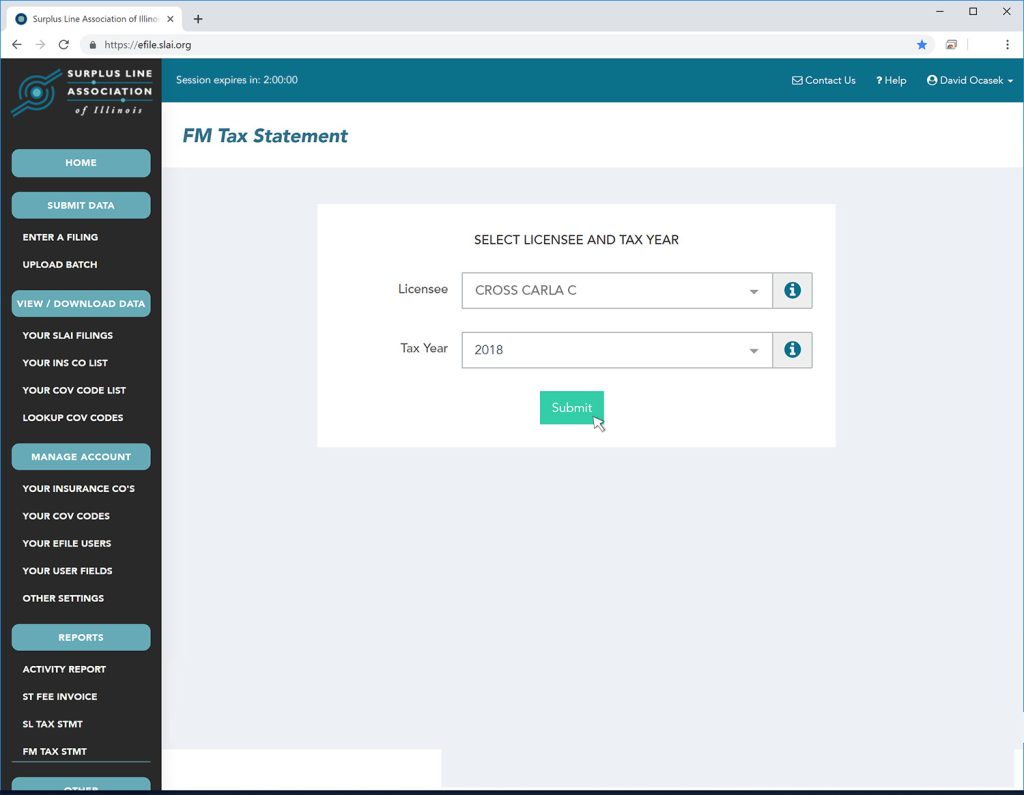

Finally, click the Submit button:

The report will open in a new tab on your browser. At that point, you can print it or download it as a pdf file.

It’s easy to see and download the policies and endorsements that make up the amounts on your tax statement.

- Log into the EFS

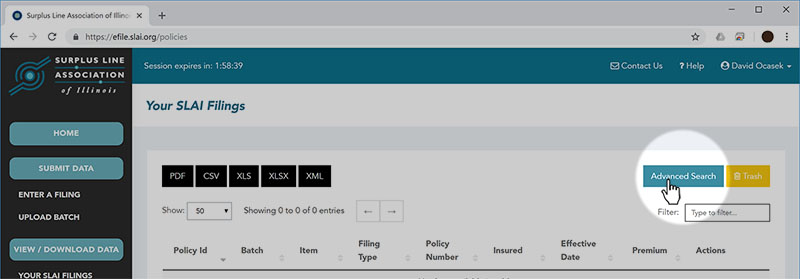

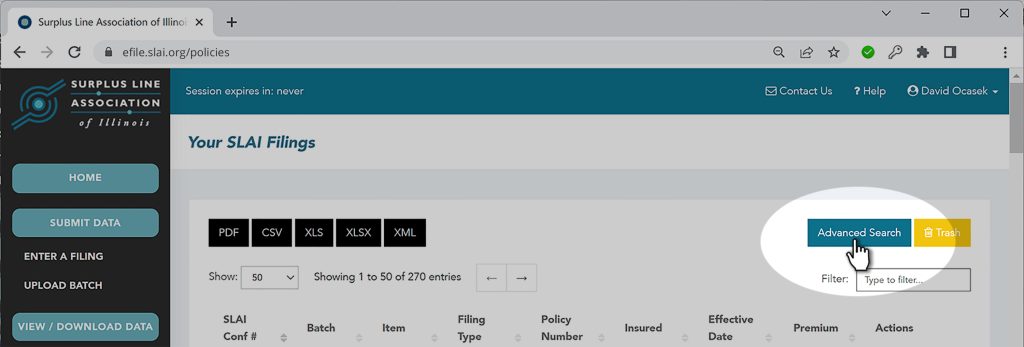

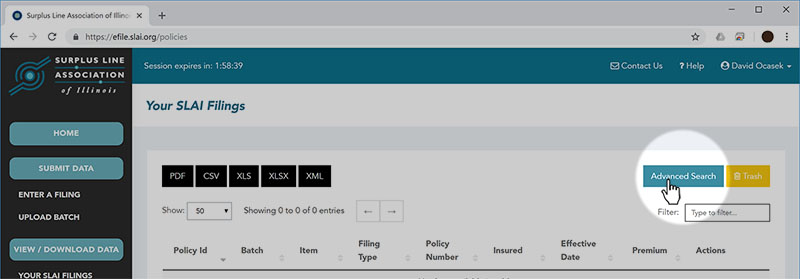

- Click on Your SLAI Filings

- Click on Advanced Search (blue button, near the top-right corner of the page)

The third item in the search form is the “Filing Month”. Filing Month is not the same as calendar month because we usually cut off the month early in June and December in order to prepare and mail your tax forms in a timely manner. You could file something on June 29th that is in the July “Filing Month”.

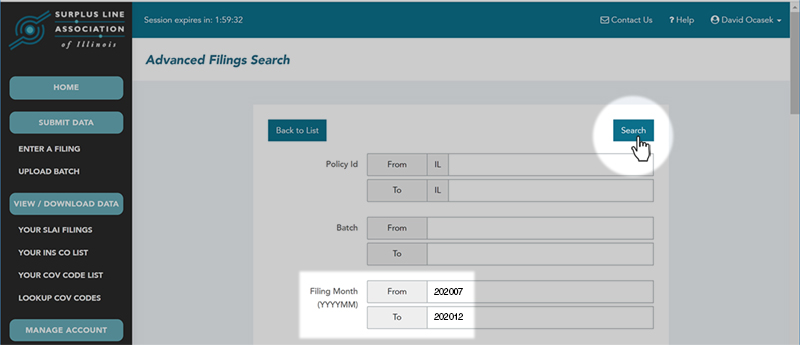

- In the From box, put the first month of the tax period as the criteria, using the YYYYMM format. For instance, if you were checking the 2nd half (July-December) of 2020 Surplus Line Tax Statement, you would use 202007 as the first month of the period.

- In the To box, put the last month of the tax period as the criteria, using the YYYYMM format. Following the same 2nd half of 2020 (July-December) example, you would use 202012.

- If you are matching up to a fire marshal tax statement, you will need all twelve filing months. So for the 2020 fire marshal tax statement, the first month would be 202001 and the last month would be 202012.

- Click the Search button.

Example:

Downloading Your Search Results

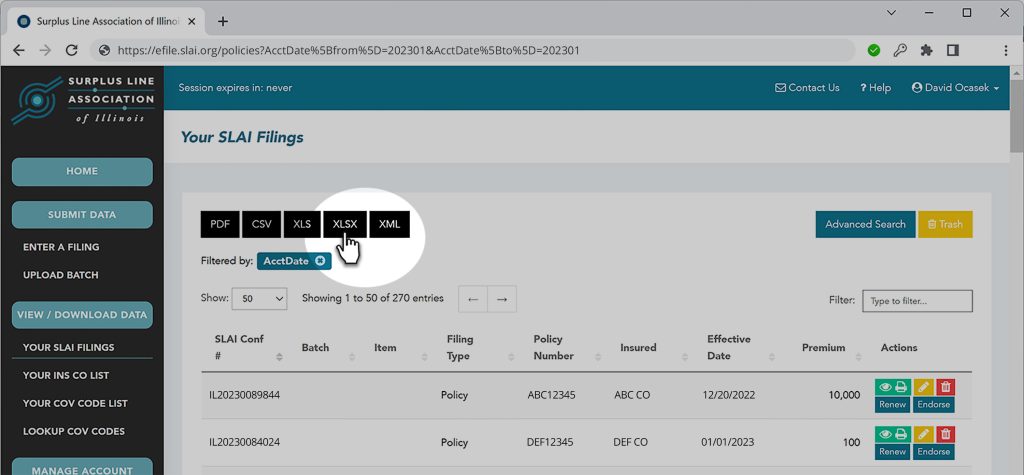

By default, the system only shows you 50 records at a time, and only shows eight data fields for each record. Don’t worry – when you download your data, you will get all the data elements for each record, and you will get all the records that match your search criteria.

The easiest way to see, search and manipulate your data is download it to an Excel file.

- Near the top-left corner of the screen, click the xls or the xlsx button (depending on your version of Excel)

- Save the file to your computer

Now, you can sort, search and manipulate your data in Excel. You may have to convert the number columns from “numbers entered as text” to actual numbers (instructions on how to convert can be found here. Total up the premiums and taxes to see that they match our tax statement. You can add subtotals by Filing Month to match up to each month on your surplus line tax statement, if desired.

DON’T CHANGE THE NUMBERS ON YOUR TAX FORM!!

By law, taxes are due based on what you filed with the Association – not based on effective dates or any other criteria. DO NOT change the numbers on your tax form. If you feel something needs to be changed, it MUST be coordinated through the Association. Contact us and we will figure it out.

We’re Here to Help

Feel free to contact our office with any questions you have about your tax statements, or for help with this process of matching up your tax statement to the policies that were filed. We’re happy to help!

It’s easy to see which policies and endorsements make up your monthly stamping fee invoice and it can be done in two ways.

Option 1: View/Print/Download Monthly Activity Report (pdf)

To view, print or download your Monthly Activity Report, follow the directions here.

Option 2: Download the Monthly Data in Excel Format

To download the data that makes up your monthly activity and ties out to your monthly Stamping Fee Invoice, follow the directions below:

- Log into the EFS

- Click on Your SLAI Filings

- Click on Advanced Search (blue button, near the top-right corner of the page)

The third item in the search form is the “Filing Month”. Filing Month is not the same as calendar month because we usually cut off the month early in June and December in order to prepare and mail your tax forms in a timely manner. You could file something on June 29th that is in the July “Filing Month”.

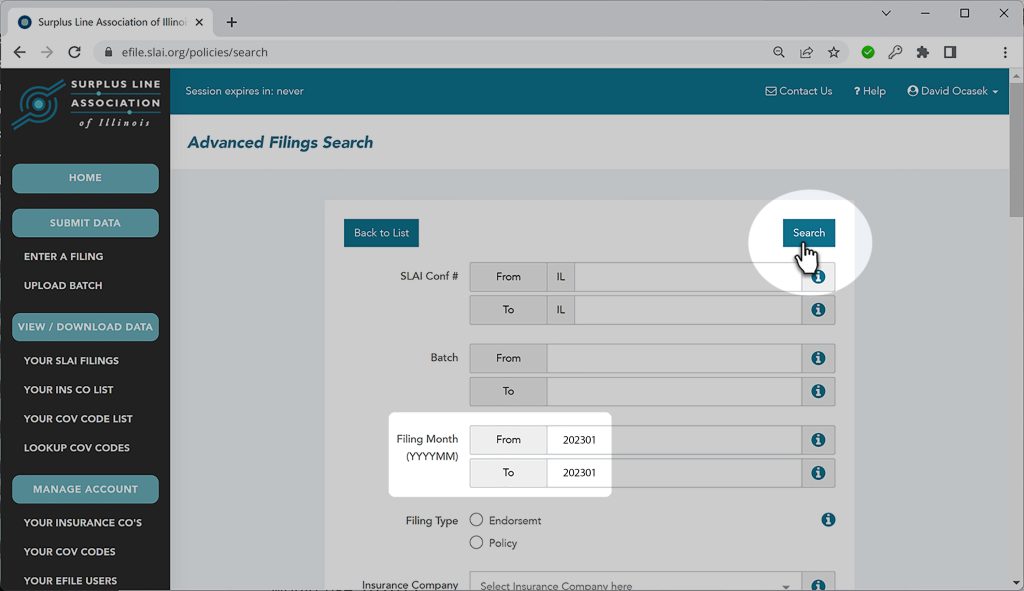

- Using the YYYYMM format, enter the month for the data you want to download into both the From box and the To box. For instance, if you want to download data for January 2026, you would enter 202601 in both boxes.

- Click the “Search” button.

Example:

Downloading Your Search Results

By default, the system only shows you 50 records at a time, and only shows eight data fields for each record. Don’t worry – when you download your data, you will get all the data elements for each record, and you will get all the records that match your search criteria.

The easiest way to see, search and manipulate your data is download it to an Excel file.

- Near the top-left corner of the screen, click the xls or the xlsx button (depending on your version of Excel)

- Save the file to your computer

Now, you can sort, search and manipulate your data in Excel. You may have to convert the number columns from “numbers entered as text” to actual numbers (instructions on how to convert can be found here. Total up the stamping fees to see that they match our stamping fee invoice.

We’re Here to Help

Feel free to contact our office with any questions you have about your monthly stamping fee invoices and viewing or downloading your monthly activity. We’re happy to help!

- Log into the EFS

- Click on Your SLAI Filings

- Click on Advanced Search (blue button, near the top-right corner of the page)

Next, you will see the search form:

Fill in the search fields as appropriate. Click on the help button for any field (the “i” in the circle to the right of each field) for help on that field. When you have entered all of your search criteria, click “Search”.

Downloading Your Search Results

By default, the system only shows you 50 records at a time, and only shows eight data fields for each record. Don’t worry – when you download your data, you will get all the data elements for each record, and you will get all the records that match your search criteria.

The easiest way to see, search and manipulate your data is download it to an Excel file.

- Near the top-left corner of the screen, click the xls or the xlsx button (depending on your version of Excel)

- Save the file to your computer

Now, you can sort, search and manipulate your data in Excel. You may have to convert the number columns from “numbers entered as text” to actual numbers (instructions on how to convert can be found here. Total up the premiums and taxes to see that they match our tax statement. You can add subtotals by Filing Month to match up to each month on your surplus line tax statement, if desired.

ADDITIONAL SEARCH TERMS:

CLICK ON A TAG BELOW TO SEE ALL DOCUMENTS WITH THAT TAG: