Important Helpful Tips

DO NOT ALTER THE NUMBERS ON THE TAX STATEMENT

By law, taxes are due based on filings with the Surplus Line Association of Illinois. The numbers on the tax form sent to you by the SLAI reflect those filings. DO NOT CHANGE THESE NUMBERS without first contacting the Association. Your check must match the amount preprinted on this form and should be made payable to “Illinois Department of Insurance.”

MAIL STATEMENT AND CHECK TOGETHER

If you owe tax, always include your check in the same envelope with your tax statement. To help avoid misapplied payments, the Department of Insurance has asked that you put your NPN number on the check.

ELECTRONIC SIGNATURES / SUBMISSION / PAYMENT

The Department of Insurance has indicated that electronic signatures on tax statements are acceptable. However, the DOI does not currently have the capability to accept submission of tax statements or tax payments electronically. Your statement and check must by physically sent to the Department of Insurance at the address on the statement via U.S. Mail or some other delivery service.

YOUR TAX STATEMENTS MUST BE FILED …

… EVEN IF NO TAX IS DUE and EVEN IF THERE WAS NO ACTIVITY. Failure to file by the Feb 1 or Aug 1 due date will result in penalties!! Check your tax statement for the listed due date or see due dates here.

KEEP ONE COPY FOR YOUR FILE …

… and send the other copy with your payment to the DEPARTMENT OF INSURANCE at the address shown on the form. DO NOT mail these forms to the Association!!

PROOF OF MAILING/DELIVERY

There is nothing in the surplus line statute that requires you to obtain proof of mailing or proof of delivery for your tax forms. However, since failure to file by the due date could subject a licensee to substantial fines and penalties, it is prudent and advisable to choose a delivery system that can provide proof of mailing and proof of delivery.

When proof of mailing and delivery is accessible online via a tracking number (as is typically the case with UPS, FedEx and USPS), please note that this proof is often no longer available after 3 months. It is advisable to access the proof of mailing and delivery online a couple of weeks after mailing, and print it out so you can keep it in your files together with your copy of the tax statement. Disputes about receipt of a tax statement or payment often do not even arise until many months, or even years, after the due date.

Section 412 of the Illinois Insurance Code states, “A tax return or report shall be deemed received as of the date mailed as evidenced by a postmark, proof of mailing on a recognized United States Postal Service form or a form acceptable to the United States Postal Service or other commercial mail delivery service, or other evidence acceptable to the Director.”

The Department of Insurance has indicated in the past that the date imprinted from a postage meter is not an acceptable proof of mailing.

If you did not receive, or cannot find, your tax statements, try reprinting them from the EFS. If you don’t have a login for the EFS or are having problems printing the statements, send an email to and we’ll be happy to send/email duplicates.

Remember, although the Association mails the tax statements out to you, you don’t mail them back to us — you mail them to the Illinois Department of Insurance at the address on the statement. So how do I know if the DOI got the statements and/or payments I sent in?

- First, the easiest way to tell is to use the tracking information you have (you did follow our advice and use a service that provides proof of mailing and proof of delivery, right?). While you are checking the tracking information, it’s a good idea to print it out to paper or to a PDF and save it with your tax information. Services that provide tracking confirmations online often only make the information available for a few months. However, in our experience, disputes about when and whether tax statements and payments were sent or received don’t occur until many months, or sometimes years, after the due date.

It is important to keep your proof of mailing. Section 412 of the Insurance Code states that “A tax return or report shall be deemed received as of the date mailed as evidenced by a postmark, proof of mailing on a recognized United States Postal Service form or a form acceptable to the United States Postal Service or other commercial mail delivery service, or other evidence acceptable to the Director.”

- Second, if you owed taxes, you can tell if the statement and check were received by checking with your bank to see if the check has cleared your account.

- If you have evidence that your statements were mailed to the DOI by the due date, but the DOI or SLAI has contacted you indicating the statements were not received by the DOI, send an explanation, a copy of your proof-of-mailing, and copies of your signed tax statements to the DOI at the email shown below.

If you failed to use a service that provides tracking, and you cannot confirm with your bank that your tax payment check cleared, you can contact the DOI by email (DOI.TaxAudit@illinois.gov). Around tax time, they are deluged with such requests and other tax problems so please (please!) contact them only if you are unable to confirm receipt through one of the other methods!

Tax statements are mailed out by the Surplus Line Association of Illinois about four weeks before the due date. They are sent directly to licensees at the surplus line license mailing address that was reported to NIPR. Sometimes, this is the licensee’s home address. However, if you have designated a separate tax statement recipient, the statements are mailed to that person.

Unless your license has expired or been canceled, tax statements are not generally available on paper, or from the EFS, until the month before they are due. If you did not receive, or cannot find, the statements, they can be reprinted on the EFS by following these instructions. If you have tried printing the statements from the EFS and were unable, you can send an email to membership@slai.org and request duplicate statements.

DO NOT ALTER THE NUMBERS ON THE TAX STATEMENT

By law, taxes are due, not based on policy effective dates or other criteria, but rather based on filings with the Surplus Line Association of Illinois. The numbers on your tax statement(s) reflect those filings. DO NOT CHANGE THESE NUMBERS without first contacting the Association. We can coordinate making corrections, if necessary, and reissuing corrected tax statements. Your check must match the amount preprinted on the tax statement and should be made payable to “Illinois Department of Insurance” and mailed to the address on the statement (not to the Association!).

For instructions regarding how to see the detail that makes up the numbers on your tax statement, click here

It’s easy to see and download the policies and endorsements that make up the amounts on your tax statement.

- Log into the EFS

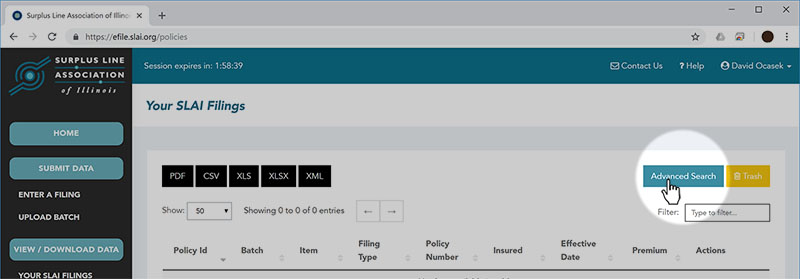

- Click on “Your SLAI Filings”

- Click on “Advanced Search” (blue button, near the top-right corner of the page)

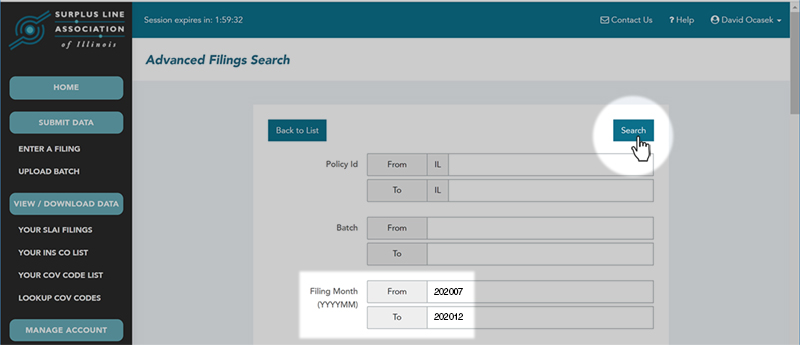

The third item in the search form is the “Filing Month”. Filing Month is not the same as calendar month because we usually cut off the month early in June and December in order to prepare and mail your tax forms in a timely manner. You could file something on June 29th that is in the July “Filing Month”.

- In the “From” box, put the first month of the tax period as the criteria, using the YYYYMM format. For instance, if you were checking the 2nd half (July-December) of 2020 Surplus Line Tax Statement, you would use 202007 as the first month of the period.

- In the “To” box, put the last month of the tax period as the criteria, using the YYYYMM format. Following the same 2nd half of 2020 (July-December) example, you would use 202012.

- If you are matching up to a fire marshal tax statement, you will need all twelve filing months. So for the 2020 fire marshal tax statement, the first month would be 202001 and the last month would be 202012.

- Click the “Search” button.

Example:

Downloading Your Search Results

By default, the system only shows you 50 records at a time, and only shows eight data fields for each record. Don’t worry – when you download your data, you will get all the data elements for each record, and you will get all the records that match your search criteria.

The easiest way to see, search and manipulate your data is download it to an Excel file.

- Near the top-left corner of the screen, click the “xls” or the “xlsx” button (depending on your version of Excel)

- Save the file to your computer

Now, you can sort, search and manipulate your data in Excel. You may have to convert the number columns from “numbers entered as text” to actual numbers (instructions on how to convert can be found here. Total up the premiums and taxes to see that they match our tax statement. You can add subtotals by Filing Month to match up to each month on your surplus line tax statement, if desired.

DON’T CHANGE THE NUMBERS ON YOUR TAX FORM!!

By law, taxes are due based on what you filed with the Association – not based on effective dates or any other criteria. DO NOT change the numbers on your tax form. If you feel something needs to be changed, it MUST be coordinated through the Association. Contact us and we will figure it out.

We’re Here to Help

Feel free to contact our office with any questions you have about your tax statements, or for help with this process of matching up your tax statement to the policies that were filed. We’re happy to help!

Make check(s) payable to the Illinois Department of Insurance.

Mail tax statements and related payments to the remittance address shown on the tax statement. For your reference, that address is:

Illinois Department of Insurance

P.O. Box 7087

Springfield, IL 62791

If you are using an overnight service that will not deliver to a PO Box, use the following address: Tax and Audit Section, Illinois Department of Insurance, 320 West Washington St., Springfield, IL 62767-0001.

Related Topics

ADDITIONAL SEARCH TERMS:

CLICK ON A TAG BELOW TO SEE ALL DOCUMENTS WITH THAT TAG: